Anil Ambani: Rise, Fall, and Redemption in Indian Business

Introduction

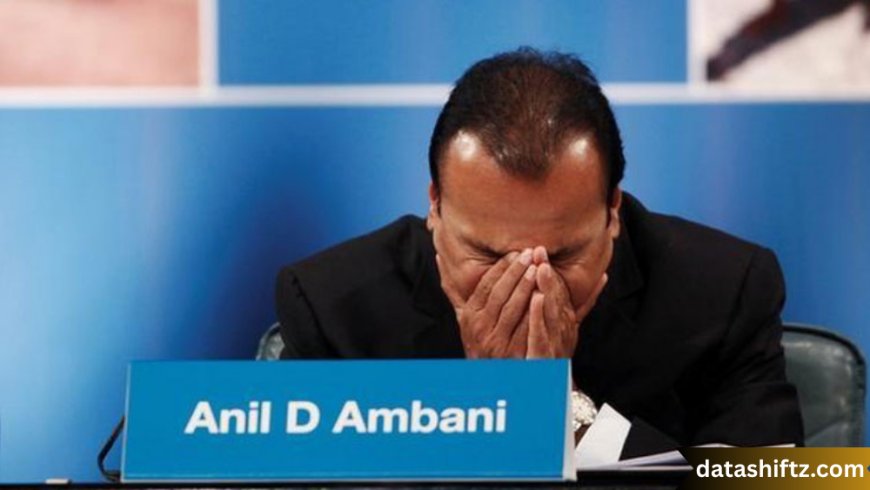

In the annals of Indian corporate history, few names have evoked as much fascination, admiration, and controversy as Anil Ambani. Once hailed as the “Blue-Eyed Boy of Indian Business,” Anil Ambani was one of the richest men in the world, managing a vast empire spread across telecom, entertainment, energy, infrastructure, and finance. However, within two decades, his fortunes drastically changed, leading to legal battles, bankruptcy declarations, and loss of control over flagship companies.

This blog explores the life, business journey, family dynamics, challenges, and possible redemption arc of Anil Ambani—offering a comprehensive look at the man who once defined India’s post-liberalization business success story.

Early Life and Education

The Heir to a Legacy

Born on June 4, 1959, in Mumbai, Anil Dhirubhai Ambani is the younger son of Dhirubhai Ambani, the legendary founder of Reliance Industries, and Kokilaben Ambani. Growing up in a business-savvy family, Anil was expected to follow in his father’s footsteps.

-

Schooling: Ambani studied at the Cathedral and John Connon School, Mumbai.

-

Higher Education: He pursued a Bachelor’s degree in Science from K. C. College, followed by an MBA from Wharton School, University of Pennsylvania.

Anil's education gave him a global perspective and modern business tools, contrasting with his father’s grassroots entrepreneurial approach.

The Rise of the Ambani Empire

Working with Dhirubhai Ambani

Anil joined Reliance Industries in the 1980s, working alongside his elder brother Mukesh Ambani. The company was expanding rapidly into petrochemicals, textiles, and refining, with both sons playing instrumental roles.

Anil was seen as the public face of the company:

-

Handled investor relations

-

Spearheaded IPOs and bond issues

-

Developed connections in international markets

The 2002 Turning Point – Death of Dhirubhai Ambani

With Dhirubhai’s passing in 2002, a power struggle emerged between Mukesh and Anil. The absence of a will led to disputes over control and vision. What began as a sibling rivalry soon evolved into a highly publicized corporate battle.

The Split and the Birth of Reliance ADA Group

In 2005, under the mediation of their mother, Kokilaben Ambani, the brothers agreed to a demerger of Reliance Industries. Anil received:

-

Reliance Communications (Telecom)

-

Reliance Capital (Finance)

-

Reliance Power (Energy)

-

Reliance Infrastructure (Infra)

This marked the birth of the Reliance Anil Dhirubhai Ambani Group (Reliance ADA Group).

Initial Success and Rapid Expansion

Anil Ambani led his new group with energy and vision:

-

Reliance Communications became India's second-largest telecom operator.

-

Reliance Power launched the largest IPO in Indian history (2008).

-

Reliance Capital entered asset management, insurance, and lending.

-

Reliance Infra worked on metro projects, airports, and roads.

His net worth soared to over $40 billion, making him one of Forbes’ richest individuals globally by 2008.

Anil Ambani's Core Companies (Post-2005 Split)

| Company Name | Sector | Notable Achievement | Current Status (2025) |

|---|---|---|---|

| Reliance Communications | Telecom | At one time served 150+ million subscribers | Bankrupt; operations ceased |

| Reliance Power | Energy | $3 billion IPO in 2008 | Operational with limited scope |

| Reliance Capital | Financial Services | Among India's top NBFCs and insurers | Under regulatory lens; restructuring |

| Reliance Infrastructure | Infrastructure | Built metro, toll roads, airports | Debt-ridden but still operational |

| Reliance Entertainment | Media & Film | Co-produced movies with DreamWorks, etc. | Active; diversified into digital content |

The Fall: Debt, Competition, and Strategic Missteps

Mounting Debt and Financial Woes

Anil Ambani’s rapid expansion came at the cost of massive borrowing. Several of his ventures, especially in telecom and power, failed to generate expected returns.

By 2019:

-

Total group debt crossed ₹1.7 lakh crore (~$22 billion)

-

Companies defaulted on loans

-

Assets were seized or auctioned

-

Investors and lenders lost trust

Jio’s Disruption – Mukesh Ambani Strikes Back

The launch of Reliance Jio in 2016 by Mukesh Ambani offered free voice and dirt-cheap data, revolutionizing Indian telecom. Reliance Communications, already struggling, could not compete and was eventually forced to shut down in 2019.

Legal Troubles and Public Embarrassment

-

Faced lawsuits from Ericsson, lenders, and regulatory bodies.

-

Declared “zero net worth” in a UK court in 2020 during a lawsuit with Chinese banks.

-

Required help from Mukesh Ambani, who paid ₹450 crore to save him from contempt charges.

Anil’s public image took a beating, contrasting sharply with Mukesh’s ever-rising fortune.

Major Challenges Faced by Anil Ambani

-

Over-leveraging: Borrowed heavily to fuel growth.

-

Misjudged markets: Especially in power and telecom.

-

Regulatory pressures: Faced scrutiny from SEBI, RBI.

-

Technological disruption: Reliance Jio changed the game.

-

Global legal disputes: Loss of reputation abroad.

-

Asset erosion: Lost control over several group companies.

-

Lack of succession planning: No clear next-gen leadership.

-

Media criticism: Constant comparisons with Mukesh Ambani.

-

Stakeholder dissatisfaction: Shareholder wealth erosion.

-

Delayed execution: Projects like Reliance Power stalled.

Anil Ambani Today: Redemption or Retreat?

A Low-Profile Life

Since the downturn, Anil Ambani has adopted a low-profile lifestyle, avoiding public and media attention. Reports suggest he is focusing on:

-

Debt resolution

-

Business restructuring

-

Legal battles and settlements

-

Reliance Entertainment’s digital media ventures

He no longer appears in the Forbes billionaire list, marking one of the most dramatic reversals of fortune in Indian business.

Possible Revival?

Though many of his ventures are now either shut or heavily downsized, Anil Ambani hasn’t declared a complete exit from the business world. Reliance Entertainment is still active and has potential in the OTT and gaming sectors.

Observers wonder if a comeback is possible, albeit in a leaner, more realistic form.

The Ambani Paradox: A Tale of Two Brothers

The contrast between Mukesh Ambani, now India’s richest man, and Anil Ambani, once among the richest but now bankrupt, reflects:

-

Different leadership styles

-

Risk appetite and strategy

-

Vision, patience, and execution

Where Mukesh focused on core infrastructure, integration, and long-term planning, Anil relied on market timing, capital markets, and rapid scaling—which eventually backfired.

Conclusion

The story of Anil Ambani is both inspiring and cautionary. It speaks of ambition, opportunity, sibling dynamics, risk, failure, and possible redemption. In a world obsessed with success stories, his journey reminds us that even the mightiest can fall, and yet, it is the resilience to rebuild that defines character.

While the world watches Mukesh Ambani build Reliance 2.0, there’s quiet curiosity about whether Anil Ambani will craft a second act—a leaner, smarter, more sustainable legacy.