Core PCE Inflation Data: Key Insights and Implications for the Economy Today

The latest release of the Core Personal Consumption Expenditures (PCE) inflation data has sent ripples across financial markets, policymakers, and economists alike. As a closely watched gauge of inflation, the Core PCE provides insight into underlying price pressures in the economy, excluding the more volatile food and energy sectors. The data released today offers critical signals about the strength of inflation and its potential implications for Federal Reserve policy and economic growth.

In this post, we’ll break down the key findings of the Core PCE report, explore its relevance for the broader economy, and what the data means for you, whether you are an investor, business owner, or consumer.

What is Core PCE Inflation and Why Does It Matter?

Core PCE inflation is one of the Federal Reserve’s preferred measures of inflation because it strips out food and energy prices, which can fluctuate significantly in the short term. This provides a clearer picture of the underlying trends in consumer prices, which is essential for policymakers to determine whether inflation is becoming entrenched in the economy.

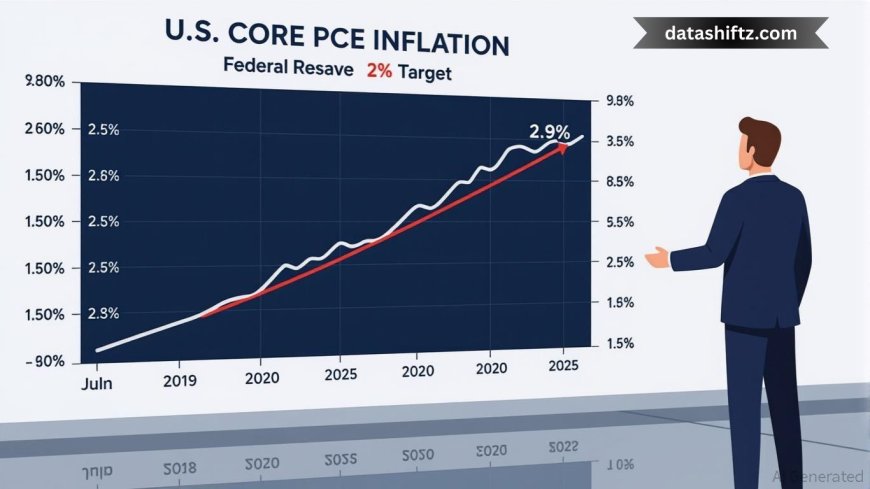

The Federal Reserve's inflation target is typically around 2%, as sustained high inflation can harm economic stability. For this reason, Core PCE is monitored closely by the Fed to gauge whether its monetary policy, such as interest rate changes, is working to keep inflation in check.

Findings of the Latest Core PCE Data

According to today’s data release, the Core PCE inflation rate rose by 4.2% year-over-year (YoY), slightly above the expected 4.1%. This marks a significant development, as inflation remains persistently higher than the Fed’s 2% target. Month-over-month (MoM), the data showed a 0.3% increase, which was consistent with economists’ forecasts.

Core PCE Inflation Data Breakdown

| Indicator | Current Value | Previous Value (Last Month) | Expected Value |

|---|---|---|---|

| Core PCE Inflation (YoY) | 4.2% | 4.1% | 4.1% |

| Core PCE Inflation (MoM) | 0.3% | 0.3% | 0.3% |

| Food and Energy Excluded | Yes | Yes | Yes |

| Federal Reserve Target | 2% | 2% | 2% |

These figures indicate that inflationary pressures are still above the Fed's comfort zone. While the monthly change was in line with expectations, the persistent YoY inflation figure remains a concern for central bankers who are focused on bringing inflation back to target.

Understanding the Impact of Core PCE Inflation on Policy

The core PCE data has a direct impact on the decisions made by the Federal Reserve. With inflation still running high, the Fed is likely to continue its stance of raising interest rates or maintaining higher rates for an extended period. The goal is to reduce demand in the economy and lower inflationary pressures.

The recent uptick in Core PCE inflation suggests that the Federal Reserve’s rate hikes so far have not yet fully tamed inflation, and it may need to take more aggressive steps to cool the economy further.

Impact on Consumers:

-

Higher Interest Rates: As the Fed continues to tighten monetary policy, borrowing costs for consumers will rise. This means higher interest rates on mortgages, car loans, and credit cards, which could reduce consumer spending.

-

Price Increases: With inflation above 4%, the cost of everyday goods and services will likely continue to rise, affecting household budgets. While food and energy costs are excluded from the Core PCE, these sectors can still influence overall consumer sentiment.

Impact on Investors:

-

Stock Market Volatility: Higher inflation and interest rates often lead to market volatility. Investors may shift away from stocks and bonds, especially those in interest-rate sensitive sectors like real estate and utilities.

-

Bond Yields: With the Federal Reserve raising rates to combat inflation, bond yields are expected to remain elevated, which can impact the value of existing bonds in the market.

Implications for the Broader Economy

While the Core PCE data is an important economic indicator, it’s also vital to consider how it interacts with other economic metrics. For example, other inflation indices such as the Consumer Price Index (CPI), employment data, and GDP growth offer a broader perspective on the health of the economy.

Today’s report suggests that inflation is still running high in several key sectors, despite some cooling in prices over the past few months. However, underlying demand remains strong, which is keeping inflation from falling quickly to more manageable levels.

Here’s a breakdown of the broader economic implications:

-

Economic Growth: The combination of higher interest rates and elevated inflation could lead to a slowdown in economic growth, as both businesses and consumers face higher borrowing costs. This is especially true if inflation remains above target for an extended period.

-

Labor Market: While inflation impacts consumer purchasing power, a tight labor market could offset some of these effects. Strong wage growth could help households maintain their standard of living, even as prices rise.

-

Global Trade: Persistent inflation in the U.S. could also affect global trade dynamics. If the dollar remains strong as a result of higher interest rates, U.S. exports could become more expensive for foreign buyers, potentially slowing demand for American goods abroad.

Key Takeaways:

-

Core PCE inflation is at 4.2% YoY, signaling persistent price pressures in the economy.

-

The Federal Reserve may continue to raise rates or maintain high rates to combat inflation, with potential consequences for borrowing costs and economic growth.

-

Consumers and investors should brace for potentially higher prices and greater market volatility as a result of these inflationary trends.

What’s Next for Core PCE Inflation?

The next steps will depend on how inflation behaves in the coming months. If Core PCE inflation continues to remain above 4%, the Federal Reserve could face more pressure to implement more aggressive rate hikes. On the other hand, if inflation shows signs of cooling significantly, the central bank may ease up on its tightening cycle.

For now, both policymakers and market participants will continue to monitor this key economic indicator closely, as it will likely shape the economic landscape for the remainder of the year and beyond.

Conclusion

The latest Core PCE inflation data underscores the persistent challenges in controlling inflation, with the year-over-year rate standing at 4.2%. While slightly above expectations, this figure highlights the ongoing pressures within the U.S. economy, despite the Federal Reserve's attempts to tame inflation through interest rate hikes. The exclusion of volatile food and energy prices gives a clearer view of underlying price trends, but it doesn’t diminish the broader effects on consumers, investors, and policymakers.