Domino’s Stock Price Today: What Investors Should Know

Domino’s Pizza Inc. (DPZ) – Stock Price Today

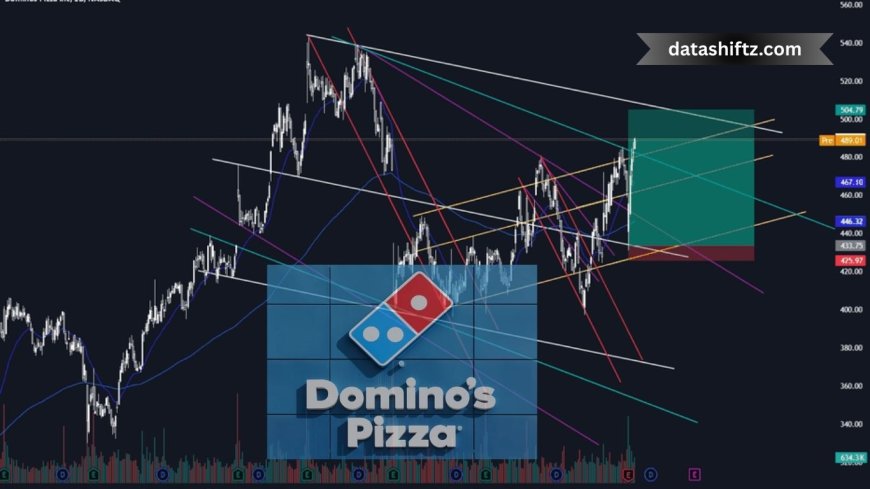

Domino’s Pizza Inc. (DPZ) is a major player in the global pizza delivery market. As of today, August 15, 2025, the DPZ stock is trading at approximately $450.59 USD, indicating minimal movement with a slight decline of roughly 0.0007% from the previous close.

This price provides a snapshot for both investors and casual observers interested in market trends or investment decisions. In the rest of this article, we’ll dissect what’s driving the stock, how it compares historically, and what forward-looking indicators to watch.

What’s Driving Today’s Domino’s Stock Price?

Recent Catalyst: Q2 2025 Earnings Results

-

Same‑store sales (U.S.) grew 3.4%, and international comps rose 2.4%, exceeding analyst expectations.

-

Revenue hit $1.15 billion, aligning with forecasts.

-

Earnings per share (EPS) dropped 5.5% to $3.81, slightly below estimates.

-

Net income fell 7.7% to $131.1 million, attributed to investment fluctuations and a higher tax rate.

Despite the earnings miss, the stronger-than-expected same-store sales and rising delivery growth sparked investor confidence. As a result, DPZ stock climbed between 3% and 6% in pre‑market trading following the release.

Strategic Highlights

-

Domino’s completed its rollout across major delivery platforms, with a new partnership with DoorDash following the end of its Uber Eats exclusivity.

-

CEO Russell Weiner emphasized robust unit economics, expanded advertising, a strong supply chain, and a thriving rewards program.

Analyst Sentiment & Outlook

-

MarketBeat still rates Domino’s as a Moderate Buy, with expectations of ~4.6% EPS growth over the next year.

-

Baird upgraded DPZ to Outperform, raising its price target to $580, citing long-term revenue and earnings growth potential through its “Hungry for MORE” strategy.

Historical Context & Forward Projections

Recent Trading Snapshot

-

On July 25, 2025, DPZ closed at around $485.53 USD, up about 1.9% that day.

-

Year-to-date, the stock had gained approximately 11% by mid-July.

Financial Overview (2024 — Q2 2025)

| Metric | Value |

|---|---|

| 2024 Revenue | ~$4.71 billion |

| 2024 Net Income | ~$584 million |

| EPS (Trailing Twelve Months) | ~$17.23 |

| P/E Ratio (TTM) | ~28.2× |

| Dividend & Yield | ~$6.96 / ~1.4% |

| 12-Month Price Target | ~$488.83 |

Analyst Insights

-

Baird projects revenue growth from ~$4.83B to ~$5.93B between now and 2027, and EPS rising from ~$15.95 to ~$22.

-

MarketBeat shows consensus for moderate buy and moderate earnings growth.

Investor Commentary (via Reddit Highlights)

-

One investor noted strong operational fundamentals in Q1 2024:

“Global retail sales growing by 7.3%… US same-store sales saw a meaningful increase of 5.6%…”

-

Another commentary around Q3/Q4 2024 noted robust margins, market share gains, and strategic rewards program success.

Summary Snapshot of DPZ Stock

| Category | Details |

|---|---|

| Current Price (Aug 15, 2025) | ~$450.59 USD |

| Recent Trading (Jul 25, 2025) | ~$485.53 USD |

| YTD Performance | ~+11% |

| Q2 2025 Key Metrics | Revenue: $1.15B; EPS: $3.81; Same-store sales: +3.4% (US), +2.4% (Intl) |

| Analyst View | Moderate Buy; Price Target: $488.83 — Baird sees upside to $580 |

| Past Growth Indicators | 2024 Revenue: $4.71B; Net Income: $584M; TTM EPS: ~$17.23 |

| Strategic Initiatives | Delivery partnerships, rewards program, marketing investments |

Key at a Glance

-

Current Stock Price: Trading around $450.59 USD as of August 15, 2025.

-

Q2 2025 Results:

-

Revenue: $1.15B (in line with expectations)

-

EPS: $3.81 (below forecasts)

-

U.S. same-store sales: +3.4%; International: +2.4%

-

-

Delivery & Partnerships:

-

Successfully expanded with DoorDash; ended Uber Eats exclusivity.

-

Rewards program and marketing fueling growth.

-

-

Analyst Sentiment:

-

Moderately bullish overall.

-

Baird target: $580, citing long-term growth strategy.

-

-

Financials:

-

2024 Revenue: ~$4.71B | Net Income: ~$584M | TTM EPS: ~$17.23

-

P/E Ratio: ~28×; Dividend Yield: ~1.4%

-

-

Investor Buzz:

-

Positive commentary on sustained growth in comps, margins, and store openings.

-

-

Risks to Watch:

-

Macroeconomic pressures, especially among lower-income consumers.

-

Competitive landscape intensifying in delivery/promo space.

-

Conclusion

The current drop to $450.59 USD reflects a short-term reaction to mixed Q2 earnings — strong top-line growth and same-store sales offset by an EPS miss and net income decline. However, fundamentals like expansion strategies, robust delivery growth, and favorable analyst targets suggest potential upside over the medium to long term.

Whether you’re a casual investor or portfolio manager, watching DPZ’s execution on its loyalty programs, delivery expansion, and cost management will be pivotal for gauging future performance.