Hang Seng Index: Latest Developments and Market Outlook

Overview of Recent Market Movements

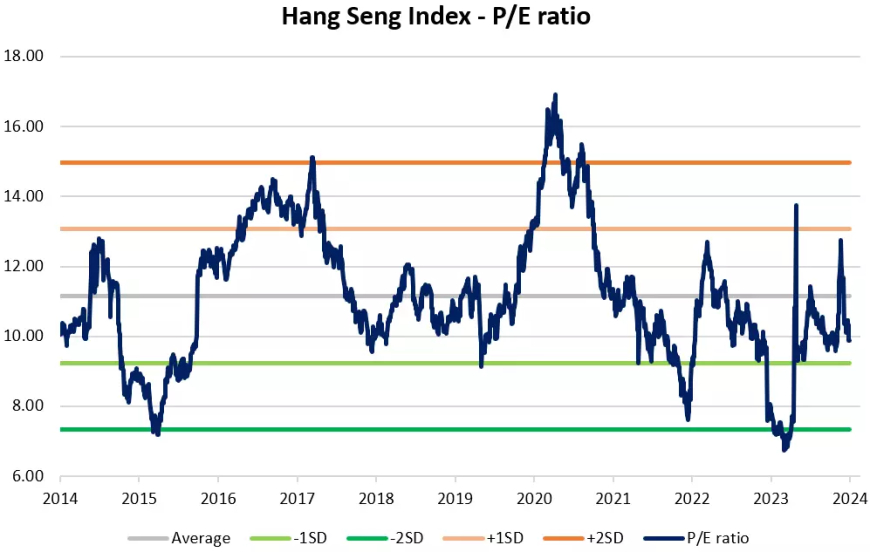

The Hang Seng Index (HSI) has experienced notable fluctuations in recent weeks, influenced by both domestic economic policies and global trade dynamics. As of May 29, 2025, the index stands at 23,282.33 points, reflecting a 1.4% decline from earlier in the week. This dip follows a surge earlier in the year, where the HSI reached a three-year high of 24,740 points in March, driven by strong performances in the technology and consumer sectors .

Influencing the Hang Seng Index

Several factors have contributed to the recent movements in the HSI:

-

Global Trade Developments: A significant development occurred when a U.S. court blocked former President Donald Trump's sweeping trade tariffs, leading to a rally in Asian markets, including the HSI .

-

Domestic Economic Policies: China's announcement of a 5% GDP growth target for 2025 and plans for infrastructure investment have bolstered investor confidence .

-

Sector Performance: Technology stocks, particularly Alibaba and Tencent, have shown resilience, contributing positively to the index's performance .

Market Outlook and Analyst Predictions

Projected Index Targets

Analysts have varied projections for the HSI's performance in the coming months:

-

Morgan Stanley: Forecasts the index could reach 25,700 points by mid-2025, citing strong earnings in the technology sector and positive economic indicators .

-

UBS: Warns of potential geopolitical tensions and interest rate hikes that could introduce volatility, setting a risk premium of 8% for the index .

Sector-Specific Insights

-

Technology: The Hang Seng Tech Index has surged over 20% from January's lows, driven by advancements in AI and strong performances from companies like Baidu and BYD .

-

Consumer and Financials: Strong consumer spending and financial sector growth have provided a solid foundation for the index's gains .

Comparative Performance Table

| Index | Current Level | Year-to-Date Change | Key Drivers |

|---|---|---|---|

| Hang Seng Index | 23,282.33 | -1.4% | Global trade tensions, domestic policies |

| Nikkei 225 | 32,000 | +1.9% | Strong corporate earnings, yen depreciation |

| DAX | 16,000 | +0.9% | Robust economic data, easing trade concerns |

| FTSE 100 | 7,500 | -0.1% | Mixed earnings, geopolitical uncertainties |

Key Takeaways

-

Market Volatility: The HSI's recent decline underscores the impact of global trade policies and domestic economic measures on market sentiment.

-

Sector Resilience: Technology and consumer sectors continue to drive growth, despite broader market fluctuations.

-

Investor Caution: Analysts advise monitoring geopolitical developments and interest rate policies, which could influence market stability.

conclusion

In conclusion, while the Hang Seng Index has faced recent challenges, underlying economic policies and sector performances suggest potential for recovery. Investors should remain informed of global and domestic developments to navigate the evolving market landscape effectively.