MRF Share Price Today: Market Trends and Investment Insights

The MRF Ltd. (National Stock Exchange symbol: MRF, Bombay Stock Exchange symbol: 500290) share continues to garner attention in the Indian markets due to its unusual price levels, strong fundamentals, and unique market positioning. As of July 8, 2025, the share closed at approximately ₹144,945, marking a 1.26% gain on the day, with a high of ₹145,555 and low of ₹142,210 .

What’s Driving MRF’s High Share Price?

Historical Lack of Stock Splits

MRF hasn’t split its shares since the mid-1970s. This means a single share has become extremely expensive. As one Redditor aptly noted:

“MRF tyres are very costly, margins are top notch and high quality. Hence the price.”

The lack of splits preserves exclusivity and keeps retail bandwidth minimal.

Strong Brand & Moat

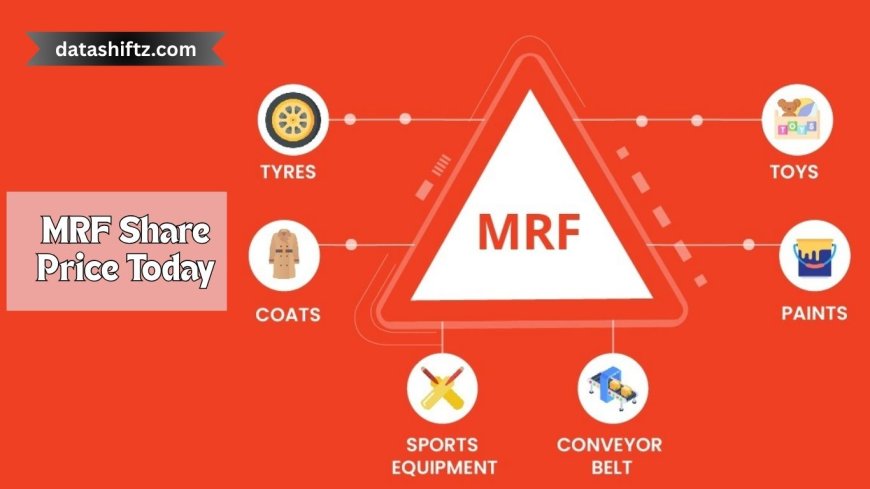

MRF is India’s largest tyre manufacturer and one of the strongest tyre brands globally (AAA– rating) . It has diversified into conveyor belts, rubber products, paints, and sports equipment — all with wide market acceptance and a solid moat.

Premium Margins & Capital Strength

-

P/E ratio: ~33×

-

Debt‑to‑equity: Very low (~0.16×)

-

ROE/ROCE: Around 10–14%

These metrics highlight robust returns and disciplined balance-sheet management.

Snapshot —Price Metrics

| Indicator | Value |

|---|---|

| Current Price | ₹144,945 (+₹1,810 / +1.26%) |

| Day's Range | ₹142,210‒₹145,555 |

| 52‑Week Range | ₹102,124–₹148,075 |

| Market Cap | ₹61,473 cr |

| P/E (TTM) | ~32.9× |

| P/B Ratio | ~3.3× |

| ROE / ROCE | ~10.6% / ~14.1% |

| Dividend Yield | ~0.16% |

What Analysts & Investors Are Saying

-

Bullish views:

Anand Rathi targets ₹160,000 — anticipating continued premium valuation . -

Cautionary stance:

Motilal Oswal maintains a SELL recommendation citing high valuation . -

Reddit sentiment:

“MRF is a good company… but margin pressure is a big pain point. Natural rubber & oil costs are high.”

Reasons for Today’s Movement

-

Better-than-expected Q4 results

Net profit jumped ~29% YoY to ₹512 cr in Q4 FY25 . -

Closing dividend record (₹229 per share) on May 7, 2025 .

-

Sector-wide optimism: Markets favored cyclical stocks, including auto‑ancillary names.

Pros & Cons – Should Investors Consider MRF Today?

Pros (Why It Appeals)

-

Long-term brand strength and pricing power

-

Pristine capital structure, low debt profile

-

Diverse product offerings and recurring income

Cons (What To Watch)

-

Extremely high per-share price makes entry difficult

-

Vulnerable to raw-material cost hikes (natural rubber, crude)

-

Minimal liquidity and lower retail investor interest

Summary & Takeaway

-

MRF’s share price is structurally high due to no splits and premium valuation.

-

Strong fundamental indicators (P/E, ROE, debt) support its long-term case.

-

Day-to-day moves reflect earnings, dividends, and commodity dynamics.

-

Analysts are mixed, with valuations holding influence over future sentiment.

-

Retail investors should assess valuation comfort and sector outlook before taking a position.

Takeaways at a Glance

-

Share price: ₹144,945 (+1.26% on July 8, 2025)

-

Valuations: High P/E, strong ROE, low leverage

-

Dividend: ₹229/share (final FY25)

-

Fundamentals: Excellent brand, diversified products

-

Risks: Cost inflation, valuation fatigue

Conclusion

The MRF share price today represents more than a stock—it’s a symbol of a legacy brand that maintained exclusivity and pricing power. Its fundamental strength is undeniable, but the premium is priced in. For those with conviction and patience, MRF offers a solid long-term bet. For others, waiting for a correction or value entry could be a safer path.