Vodafone Share Price: A Deep Dive into Performance, Trends, and Future Outlook

Introduction

Vodafone Group Plc, a multinational telecommunications company headquartered in the UK, has long been one of the most recognized names in the telecom industry. With a global footprint spanning Europe, Africa, and Asia, Vodafone is not just a communications giant—it is also a significant player in global equity markets. The Vodafone share price is closely followed by retail investors, institutional players, and market analysts, as it reflects not only the company’s financial health but also broader trends in the telecom sector.

In this article, we analyze the historical performance of Vodafone shares, explore factors influencing its price, review recent trends, and assess the company's prospects for investors.

Understanding Vodafone’s Market Position

Company Overview

Vodafone operates mobile and fixed networks in more than 20 countries and partners with networks in over 40 more. The company is also involved in Internet of Things (IoT), cloud services, and enterprise communication solutions.

Key Financial Metrics (FY 2023)

| Metric | Value (approx.) |

|---|---|

| Revenue | €45.7 billion |

| Operating Profit | €14.3 billion |

| Net Debt | €36.2 billion |

| Market Capitalization | ~£20 billion (as of 2024) |

| Dividend Yield | ~8% |

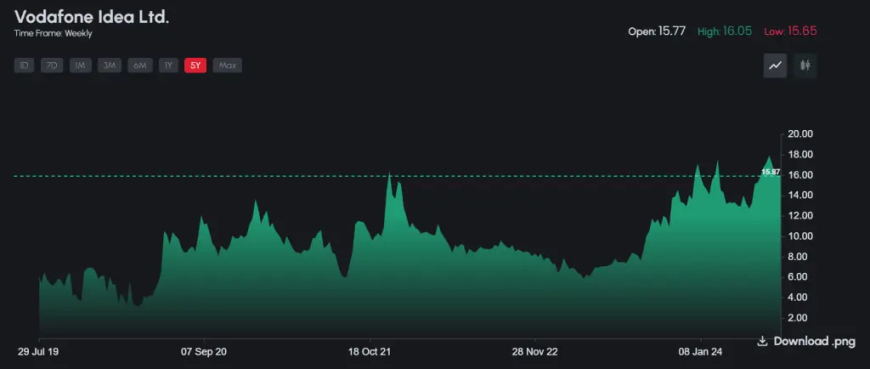

Vodafone Share Price Performance: A Historical Review

Vodafone’s share price has experienced significant ups and downs over the past two decades. It peaked during the early 2000s telecom boom, but since then, the stock has seen varying degrees of volatility driven by regulatory pressures, competition, and large-scale strategic investments.

Historical Share Price Milestones

-

2000: Share price peaked above 400p during the dot-com boom.

-

2008-2009: Fell sharply during the global financial crisis.

-

2014: Minor rally on the back of strong earnings and European expansion.

-

2020-2021: COVID-19 impact and renewed focus on digital infrastructure.

-

2023-2024: Decline due to market saturation and geopolitical uncertainties.

Recent Trends in Vodafone Share Price

Vodafone Share Price – Past 12 Months (London Stock Exchange: VOD)

| Month | Closing Price (GBP) | Key Event/News |

|---|---|---|

| May 2023 | 94.5p | Quarterly earnings miss |

| July 2023 | 87.0p | EU market pressure & revenue decline |

| September 2023 | 90.2p | New strategic investment in Africa |

| December 2023 | 84.6p | Dividend payout & investor pullback |

| February 2024 | 78.9p | Negative global telecom sector outlook |

| May 2024 | 82.3p | Recovery on cost-cutting and asset divestment |

Vodafone's share price has shown modest recovery in early 2024, largely due to internal restructuring and renewed investor confidence.

Factors Affecting Vodafone Share Price

1. Regulatory Environment

Vodafone operates in tightly regulated markets. Policy changes around net neutrality, spectrum licensing, or foreign investment can impact profitability and investor sentiment.

2. Competition

Intense price competition in Europe and India has historically impacted margins. The entry of low-cost carriers often triggers price wars, leading to revenue pressure.

3. Mergers and Acquisitions

Vodafone’s M&A activities—such as the acquisition of Liberty Global's operations or the sale of assets in India—impact both debt levels and investor outlook.

4. Debt Load

Vodafone’s substantial debt affects its valuation. Investors closely monitor how the company manages its leverage and refinancing strategy.

5. Currency Fluctuations

As Vodafone earns revenue in multiple currencies, fluctuations—especially a weak pound—can influence financials and, in turn, share prices.

Reasons Investors Track Vodafone Shares

-

High Dividend Yield

Attractive for income investors, Vodafone often maintains generous dividend payouts. -

Global Exposure

Vodafone provides diversified international revenue streams across continents. -

Infrastructure Growth

Investment in 5G, fiber optics, and cloud services holds long-term promise. -

Restructuring Efforts

Strategic moves to reduce debt and focus on core markets improve outlook. -

Sustainability Goals

ESG (Environmental, Social, Governance) compliance is increasingly appealing to ethical investors.

Vodafone in the Digital Age

The digital revolution has created opportunities for telecom players to diversify and grow. Vodafone is focusing on several strategic initiatives:

Vodafone’s Key Focus Areas (2024 Onwards)

| Initiative | Description |

|---|---|

| 5G Expansion | Rolling out 5G across Europe and Africa |

| Vodafone Business | Serving corporate clients with cloud solutions |

| TowerCo (Vantage Towers) | Independent tower operations to reduce costs |

| IoT Development | Smart cities, industrial IoT, and connected devices |

| Green Tech | Investing in carbon neutrality and energy efficiency |

Risks and Challenges Ahead

While there is much optimism around Vodafone’s transformation, risks remain.

Key Risks

-

High Debt Levels: Limits flexibility for future investments.

-

Stiff Competition: Margins under constant pressure in saturated markets.

-

Geopolitical Uncertainty: Operations in markets like Turkey, Egypt, and India are susceptible to instability.

-

Changing Consumer Behavior: Shift from traditional voice/data to OTT platforms affects revenue.

Investors must evaluate whether the potential rewards outweigh the risks.

Analyst Ratings and Investor Sentiment

Financial analysts hold mixed views on Vodafone shares. While some see long-term potential and solid dividend value, others remain cautious due to earnings stagnation.

Current Analyst Consensus (as of May 2024)

| Broker | Rating | Target Price |

|---|---|---|

| JPMorgan | Overweight | 95p |

| Barclays | Equal Weight | 85p |

| Deutsche Bank | Hold | 88p |

| HSBC | Buy | 98p |

| Morgan Stanley | Underweight | 75p |

Conclusion

The Vodafone share price remains a topic of interest for both long-term investors and short-term traders. While challenges such as debt and competition continue to impact growth, strategic restructuring, 5G rollout, and a focus on enterprise services present promising opportunities. With its global footprint and investor-friendly policies like dividend payouts, Vodafone remains a stock to watch closely.

Whether you're a seasoned investor or a curious observer of market trends, Vodafone’s journey encapsulates the trials and triumphs of the global telecom industry.