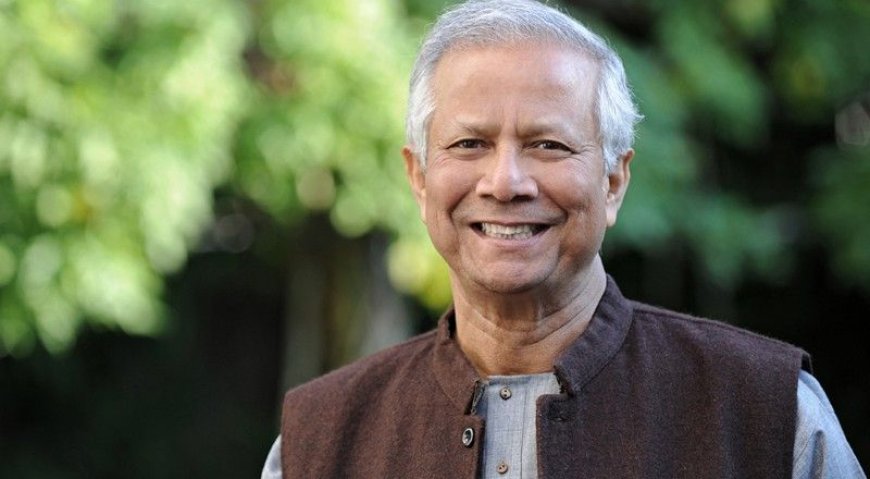

Muhammad Yunus of Bangladesh: Architect of Social Business and Microfinance Revolution

Introduction

Professor Muhammad Yunus is a globally acclaimed Bangladeshi economist, banker, social entrepreneur, and Nobel Peace Prize laureate whose pioneering work in microfinance and social business has transformed lives across the world. Often referred to as the "Banker to the Poor," Yunus is best known for founding Grameen Bank, a financial institution that provides small loans to the impoverished without requiring collateral. His innovative approach to poverty alleviation has redefined economic development and inspired similar initiatives in numerous countries.

In this article, we delve into the life, vision, achievements, and enduring legacy of Muhammad Yunus, showcasing his extraordinary contribution to socio-economic development through structured sections including headings, tables, and lists.

Early Life and Education

Humble Beginnings in Chittagong

Muhammad Yunus was born on June 28, 1940, in the port city of Chittagong in British India (now Bangladesh). He grew up in a middle-class family and displayed academic excellence from a young age.

Academic Journey

He earned his BA and MA in Economics from Dhaka University before receiving a Fulbright scholarship to study in the United States. He completed his PhD in Economics from Vanderbilt University in 1971 and taught as an Assistant Professor at Middle Tennessee State University.

Grameen Bank and the Microfinance Revolution

Founding of Grameen Bank

In 1976, deeply moved by the poverty he witnessed in rural Bangladesh, Yunus initiated a micro-lending experiment in the village of Jobra. His idea was simple yet radical: lend small amounts to the poor, especially women, without asking for collateral. The initiative grew and evolved into the Grameen Bank in 1983.

Key Features of Grameen Bank

| Feature | Description |

|---|---|

| Loan Size | Small amounts (as low as $20–$100) |

| Target Demographic | Poor women in rural areas |

| Repayment Terms | Weekly installments, low interest |

| Collateral Requirements | None |

| Group Lending Mechanism | Borrowers form small groups for mutual accountability |

This model of microcredit provided economic freedom to millions and was replicated globally in countries like India, the Philippines, and even parts of the United States.

Achievements and Recognitions

Nobel Peace Prize (2006)

Muhammad Yunus and Grameen Bank were jointly awarded the Nobel Peace Prize in 2006 “for their efforts to create economic and social development from below.” This historic recognition was a turning point for microfinance and social entrepreneurship worldwide.

Other Notable Awards

| Year | Award/Recognition | Organization |

|---|---|---|

| 1994 | World Food Prize | World Food Prize Foundation |

| 1998 | Prince of Asturias Award | Spanish Government |

| 2006 | Nobel Peace Prize | Norwegian Nobel Committee |

| 2008 | Presidential Medal of Freedom (USA) | U.S. Government |

| 2009 | Congressional Gold Medal (USA) | U.S. Congress |

The Concept of Social Business

What is Social Business?

Social business is a concept developed by Yunus that combines the social mission of a non-profit with the financial discipline of a business. In a social business, the objective is not to maximize profits but to solve social problems in a financially sustainable way.

Seven Principles of Social Business

-

Business objective is to overcome poverty or a social problem.

-

Financial and economic sustainability.

-

Investors get back their investment amount only; no dividend.

-

Profit is used for expansion and improvement.

-

Gender sensitive and environmentally conscious.

-

Workforce gets market wage with better working conditions.

-

Do it with joy.

Impact of Muhammad Yunus's Work

On Poverty Alleviation

Muhammad Yunus's initiatives have helped millions of families escape the vicious cycle of poverty by enabling them to start small businesses, buy livestock, or fund their children's education.

On Women's Empowerment

A significant portion of Grameen Bank’s borrowers are women (over 90%), and the microcredit approach has drastically improved women's roles in household decision-making and community leadership.

Global Influence

Yunus's model has influenced:

-

UN SDG Goal 1: No Poverty

-

Social entrepreneurship movements globally

-

Policymaking in countries exploring inclusive financial models

Controversies and Criticisms

Despite his widespread acclaim, Yunus has not been free from controversy. Critics have questioned the long-term sustainability of microcredit and its actual impact on poverty. Additionally, in 2011, Yunus was removed from Grameen Bank by the Bangladesh government over age-related policy disagreements, sparking national and international debate over governance and autonomy in social enterprises.

Legacy and Continued Work

Institutions Founded by Yunus

| Institution | Focus Area |

|---|---|

| Grameen Bank | Microfinance |

| Grameen Shakti | Renewable energy in rural areas |

| Grameen Telecom | Mobile access for the poor |

| Yunus Centre | Advocacy and development of social business |

Books Authored

-

Banker to the Poor (1999)

-

Creating a World Without Poverty (2007)

-

Building Social Business (2010)

-

A World of Three Zeros (2017)

These books have been widely read and have helped popularize concepts of microfinance and social entrepreneurship.

Quick Summary List

Top 5 Contributions of Muhammad Yunus

-

Founder of Grameen Bank and pioneer of microcredit.

-

Empowered millions of rural women through financial inclusion.

-

Authored globally influential books on poverty and economics.

-

Nobel Peace Prize Laureate for peace-building through finance.

-

Originator of the “Social Business” concept.

Conclusion

Muhammad Yunus of Bangladesh is a visionary whose life’s work has impacted the lives of millions. By challenging conventional banking systems and introducing an inclusive, ethical, and practical model for economic empowerment, he has not only reshaped Bangladesh’s socio-economic landscape but also inspired global movements toward social entrepreneurship and inclusive development.

His legacy lives on in every rural woman who starts a small business, every social enterprise solving a community problem, and every student reading about how one man’s idea changed the world. As the challenges of poverty and inequality persist, the principles laid down by Yunus offer hope and direction for future generations striving to create a fairer and more just world.